In a rational world, the Federal government would act as a motivated lease owner who was interested in promoting the safe and environmentally responsible development of his mineral resource, consistent with sound conservation practice. That’s why there’s a permit process in the first place.

Since Macondo, that’s backwards. Operating practices must conform to the permitting process that has, um, evolved in a purely political environment: practical considerations, economics and common sense be damned. And while the politicians proclaim a concern for production levels, product prices and jobs, their actions and policies tell another story.

A study (pdf link) of Gulf of Mexico activity released on Wednesday by the Gulf Economic Survival Team (GEST) indicates that much of the progress claimed by the Obama Administration is illusory. The Administration is putting a lot of time and effort into buffing the statistics to make it appear as though things are going swimmingly. (Just like in kids’ sports, ownership of the official scorebook can be a significant advantage. It never hurts to keep one eye on the scorekeeper.)

The study was performed by Dr. Bernard L. Weinstein of SMU’s Cox School of Business.

[It details] the fallout from two years of difficulty implementing offshore regulations that were revamped after the Macondo blowout. The continuing regulatory issues have led to decreased federal revenue, fewer active rigs in the Gulf, and lower forecasts of future production from the Gulf of Mexico. …

According to the report, companies attempting to plan and execute enormously expensive, multi-year offshore energy projects are not receiving the transparency and predictably required to conduct business. When the market lacks confidence that the government will remove obstacles to energy production in the Gulf of Mexico and elsewhere, traders incorporate this risk into current thinking and future price structures. Today’s offshore regulatory regime has bred a high “U.S. regulatory risk premium” that is dampening production and causing a hidden surcharge on the price of oil and gasoline in the market.

Dr. Weinstein’s executive summary highlights the problems with permitting and transparency:

- Federal revenues from Gulf activity dwindle: Lease sales that brought billions of dollars in bonus consideration as recently as 2008 returned only $36 million in 2011’s only lease sale. With production off (see below), royalty income is down.

- GOM rig count increases are misleading: Notwithstanding “official” rig statistics, the number of rigs actually drilling wells has declined from 27 before Macondo to 18 as of May 1.

- Deemed ‘submitted’ period expanded: Now the staff goes over a new plan with a fine tooth comb to verify that it is 100% complete before it is “deemed submitted” – a new step in the process that makes it appear that permits are still being handled expeditiously. Since Macondo, the total time required for an average plan approval has ballooned from 50 to 207 days.

- Permit approval claims overblown: Many permits counted in the statistics were to restart operations suspended due to Macondo. Of 94 permits grant, only 32 were for actual new wells targeting hydrocarbons.

- Just-in-time permitting breeds uncertainty: With 18 active deep-water rigs, the inventory of approved, “ready-to-go” permits should be at least 54. As of March 31, there were only 6 – leading companies to question where their rigs will be going next.

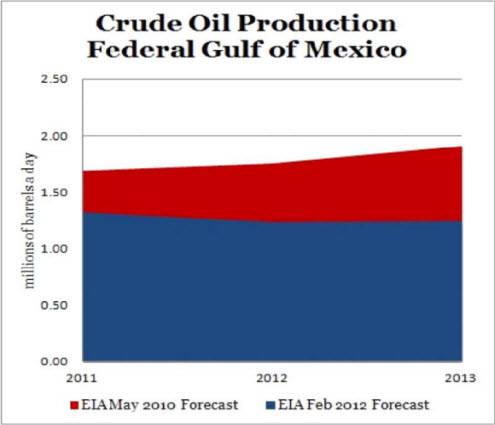

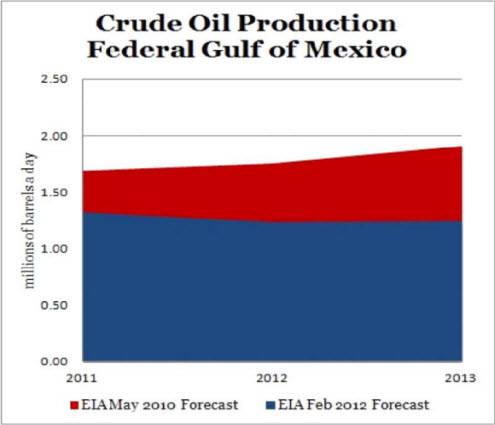

The study further confirms what has previously been reported in these pages: current levels of oil production (in blue) from the Gulf are running 30% below what was expected in the last pre-Macondo production forecast (in red):

That shortfall is nearly 10% of domestic production. According to Dr. Weinstein, it affects the consumer’s price at the gasoline pump. He concludes:

The outlook for oil and gas production in the Gulf of Mexico remains murky. Companies making massive investments of capital and time require predictability and confidence that production goals can be met. If companies find it increasingly difficult to tell their own executives and board members when projects are going to be approved, this uncertainty will affect decisions about where to place future capital investment. Investors need reasonable predictability or they will simply look elsewhere for more inviting opportunities. If Gulf production is to reach levels that equal its true potential in the months, years, and decades to come, the regulatory sphere must deliver on its obligation to provide a predictable review and approval process.

President Obama is on target when calling for an “all-of-the-above” energy strategy, both to enhance domestic production—with all the attendant benefits of jobs and revenue—and to ensure America’s energy security. The Gulf of Mexico contains some of the world’s largest reservoirs of recoverable crude oil and natural gas. Bringing reasonable speed and transparency to the permitting process for deep water drilling is a critical component of a meaningful all-of-the-above domestic energy strategy. Absent such actions, American households and businesses will continue to pay a hidden “surcharge” on oil and gasoline that reflects the current regulatory risk premium.

Emphasis mine.

Cross-posted at RedState.com.

Actors Kevin Costner and Stephen Baldwin opened a real-life legal drama on Monday as jury selection began in a trial over Baldwin’s claims that Costner cheated him out of his share of a multi-million dollar deal to sell oil-cleanup devices 2010.

region that oversees Texas [*] wrote a letter to the U.S. Army Corps of Engineers saying 61 water crossings near Galveston are too large for the broad permits being pursued. The official wants an environmental review that includes a public comment period.

region that oversees Texas [*] wrote a letter to the U.S. Army Corps of Engineers saying 61 water crossings near Galveston are too large for the broad permits being pursued. The official wants an environmental review that includes a public comment period.